Mid-Year M&A Trends 2025: Global Market Defies the Headwinds

Key Messages

Global M&A deal value rose over 10% year-over-year in H1 2025, despite lower deal volume.

Technology and AI-driven megadeals led the way, with the U.S. contributing around 60% of global deal value.

Private equity sponsors remain active, directing capital toward stable, high-growth sectors.

Global Market Overview: Resilient Despite Headwinds

The year began with optimism. Markets anticipated a rebound in M&A, supported by lower interest rates, regulatory easing, and improving macroeconomic sentiment. Yet escalating geopolitical tensions — particularly in the Middle East — and renewed trade uncertainty in the U.S. introduced new challenges.

Even against this backdrop, the M&A market proved more resilient than expected. PwC’s H1 2025 report shows deal values rose 15% year-over-year, despite continued declines in deal volume. This suggests that activity was fuelled by larger, more strategic transactions and megadeals — a clear signal of the market’s flight to scale and relevance.

Technology was the standout sector, driven by surging demand for artificial intelligence. J.P. Morgan reported that technology accounted for nearly a quarter of global deal value, with both strategics and financial sponsors aggressively pursuing AI capabilities and infrastructure as critical enablers of long-term competitiveness.

Regional Performance: U.S. Leads, EMEA Finds Momentum

According to BCG, the United States remained the anchor of global M&A, representing roughly 60% of global deal value. U.S. activity was strong across both corporate and sponsor-led deals, with particular concentration in technology and energy. Corporates were selective but decisive, while sponsors targeted platforms with earnings visibility and scalable potential.

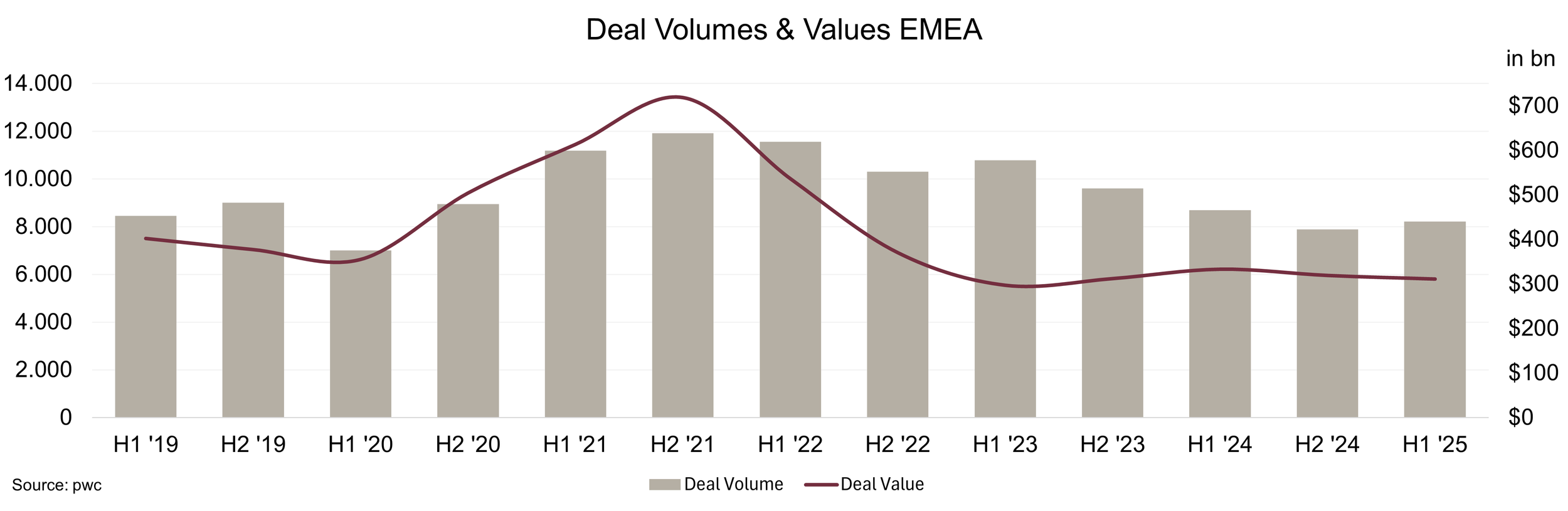

In Europe, overall volumes and values fell compared to H1 2024, impacted by a slowdown in U.K. megadeals and ongoing macro-political uncertainty (as reported by PwC). Still, sentiment is stabilizing. BCG’s Global M&A Sentiment Index held steady at 80 in Q2, marking the first time Europe outperformed North America in dealmaking sentiment in two years.

One of the brightest spots was the DACH region (Germany, Austria, and Switzerland), which nearly doubled deal volume versus last year. Deals such as Helvetia’s acquisition of Baloise, Apleona’s sale to Bain Capital, and Erste Group’s intent to acquire a 49% stake in Santander illustrate renewed confidence, particularly in financial services.

Elsewhere in EMEA, results were mixed. Transaction numbers remain below the 10-year average (J.P. Morgan), but the MENA region achieved the highest year-over-year growth, powered by sponsor activity, oil & gas megadeals, and portfolio reshaping by sovereign wealth funds.

Sector Activity: AI, FIG, and Energy at the Forefront

The strongest momentum emerged in three core sectors:

Technology – Strategic M&A accelerated sharply, with acquisitions focused on AI platforms and supporting infrastructure. For many businesses, acquisition is becoming the fastest path to AI capability.

Financial Institutions Group (FIG) – Global financial services activity rose 56%, driven by consolidation in Europe. The Helvetia–Baloise and Erste–Santander transactions underscore the trend.

Energy & Utilities – Deals such as Chevron’s acquisition of Hess and Constellation Energy’s proposed transaction with Calpine highlight sustained investment across both traditional and renewable assets.

By contrast, cyclical sectors such as consumer goods and industrials remained muted, weighed down by weak consumer spending and persistent inflationary pressures, according to BCG. Chemicals are entering a new consolidation phase, but here the driver is complexity — regulatory burdens are pushing companies toward scale and simplification.

Outlook: The Road Ahead for 2025

The second half of 2025 is set to remain constructive, though measured. A consistent global trend is that deal timelines are lengthening. Buyers and sellers are approaching valuations and diligence with greater caution, leading to slower closings. As a result, many advisory firms — including ours — are advising clients to build in additional time buffers for planning and negotiations.

Key expectations:

Megadeals will continue to underpin overall deal value, especially in technology, energy, and financial services.

Financial sponsors remain under pressure to deploy capital, favoring businesses with strong revenue visibility and stable cash generation. Such companies are commanding higher valuations.

AI and technology transactions will remain dominant, both in volume and in strategic importance, as firms compete for scale and capabilities.

While risks remain, many dealmakers are pressing ahead decisively, prioritizing long-term positioning over short-term perfection.

Final Thoughts

The first half of 2025 has shown that global M&A is not just enduring — it is adapting.

Despite economic and political headwinds, dealmakers remain active, disciplined, and strategic. Deal value rose sharply, powered by megadeals in AI, financial services, and energy. The U.S. continues to lead, while Europe and the Middle East are regaining momentum.

The outlook for the rest of the year points to more of the same: extended deal timelines but steady underlying demand. For both strategic acquirers and sponsors, the focus is firmly on businesses with scale, resilience, and long-term value creation potential.

Key Takeaways

Deal value is up 15% YoY, led by large strategic transactions across core sectors.

AI and technology M&A made up nearly a quarter of global deal value in H1 2025.

Financial services activity grew 56%, with consolidation momentum across Europe.

The U.S. accounted for around 60% of global deal value.

Sponsors remain highly active, favoring stable, cash-generative assets with long-term growth potential.

Frequently Asked Questions

Q: What are the key drivers of M&A activity in 2025?

A: Growth has been led by megadeals in AI, financial services, and energy. Both strategics and sponsors are focusing on sectors with resilience and long-term growth prospects.

Q: Which regions are most active right now?

A: The U.S. continues to lead, while DACH and MENA have recorded strong regional growth. EMEA overall is showing signs of recovery, though volumes remain below the long-term average.

Q: Why are deal timelines longer this year?

A: Increased diligence, regulatory scrutiny, and valuation gaps are extending the process. We advise clients to account for these factors when planning.

Q: What’s the outlook for the rest of the year?

A: Deal value is expected to remain strong, with megadeals and technology-led transactions at the center. Financial sponsors will stay active, and consolidation in financial services is likely to continue.

If you would like to learn more about us, we’d be happy to talk.